Choosing the right credit card can feel overwhelming given the sheer number of options available in the U.S. market. Whether you’re looking for cashback rewards, travel perks, low fees, or high credit limits, there’s a card tailored for your needs. In this guide, we’ll compare some of the top credit cards based on their benefits, fees, and credit limits to help you make an informed decision.

Key Factors to Consider When Choosing a Credit Card

- Rewards and Perks: Cashback, points, or miles? Understanding what you value most can help narrow your choices.

- Annual Fees: Some cards come with no annual fee, while premium cards may charge hundreds of dollars annually.

- APR (Annual Percentage Rate): Consider the interest rates, especially if you’re planning to carry a balance.

- Credit Limits: Higher limits can be beneficial for larger purchases and improving credit utilization.

- Additional Benefits: Fraud protection, travel insurance, or exclusive access to events might tip the scale.

Top Credit Cards in the U.S. for 2025

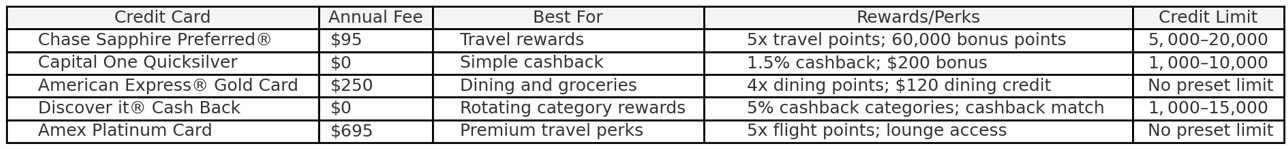

1. Chase Sapphire Preferred® Card

Chase Sapphire Preferred Card

- Best for: Travel rewards

- Benefits:

- 60,000 bonus points after spending $4,000 in the first 3 months (worth $750 in travel through Chase Ultimate Rewards®).

- 5x points on travel purchased through Chase Ultimate Rewards.

- No foreign transaction fees.

- Fees:

- Annual fee: $95

- Credit Limit: $5,000 – $20,000 (varies based on creditworthiness)

2. Capital One Quicksilver Cash Rewards Credit Card

Credit Cards CapitalOne

- Best for: Simple cashback

- Benefits:

- Unlimited 1.5% cashback on every purchase.

- No foreign transaction fees.

- $200 cash bonus after spending $500 within 3 months.

- Fees:

- No annual fee

- Credit Limit: $1,000 – $10,000 (depending on credit score)

3. American Express® Gold Card

Credit Cards AE Gold

- Best for: Dining and groceries

- Benefits:

- 4x Membership Rewards® points at restaurants, including takeout and delivery in the U.S.

- 3x points on flights booked directly with airlines or on amextravel.com.

- $120 annual dining credit.

- Fees:

- Annual fee: $250

- Credit Limit: Charge card (no preset spending limit, but requires monthly balance payment)

4. Discover it® Cash Back

Credit Cards Discover

- Best for: Rotating category rewards

- Benefits:

- 5% cashback on rotating categories each quarter (up to $1,500 in purchases).

- Unlimited cashback match for the first year.

- Free FICO® credit score monitoring.

- Fees:

- No annual fee

- Credit Limit: $1,000 – $15,000

5. The Platinum Card® from American Express

Credit Cards AE Platinum

- Best for: Premium travel perks

- Benefits:

- 5x points on flights booked directly with airlines or through Amex Travel.

- Access to Centurion Lounges and over 1,400 airport lounges worldwide.

- Up to $200 annual airline fee credit.

- Fees:

- Annual fee: $695

- Credit Limit: No preset spending limit

Comparison Table

All Cards

Tips for Maximizing Credit Card Benefits

- Pay Your Balance in Full: Avoid high-interest charges by paying off your balance every month.

- Take Advantage of Sign-Up Bonuses: Plan your spending to meet the minimum spend requirements.

- Leverage Category Bonuses: Use specific cards for their highest reward categories.

- Monitor Your Credit Score: Many cards offer free credit score tracking—use this tool regularly.

- Redeem Rewards Wisely: Choose travel or cashback redemptions to maximize value.

Conclusion

The best credit card for you depends on your lifestyle, spending habits, and financial goals. Cards like the Chase Sapphire Preferred® are excellent for travel lovers, while the Capital One Quicksilver suits those who prefer straightforward cashback. Evaluate your priorities and leverage the benefits to get the most out of your card.

Found this guide helpful? Share it with your friends or check out more tips on maximizing your finances at UpTipz.com.

🙂